|

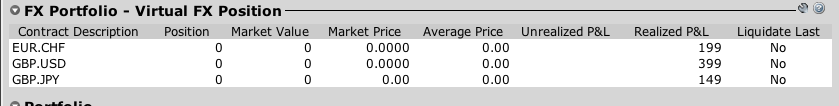

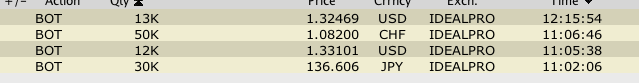

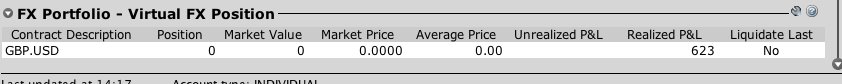

6/30/2016 1 Comment Happy Early Canada Day +$747Today was another quiet session, prepared few trade ideas for CAD GDP data but the data release did not meet our criteria. Then i basically just read news and keep eyes & ears open for any news. Another political showdown in Britain now, and that was pretty much all we had for this week. Then finally at 11am EST, Carney’s speech had driven GBP & EUR down. The price dropped more than 100 pips in seconds after the Squawk, it was so unbelievable that not too long ago i was still that novice trader who traded without any instant information... yes all these information cost money, but if you don’t even have the basic business tools to compete in this market, then what do you really expect? Information is amazing! I had the bloomberg TV on as well, and by the time most audiences got the news, that was already 5 minutes later. Nowadays i don’t trade without info tools. Anyway, the dovish tone has helped all my 3 trades, however, I made a decision to exit EUR/CHF & GBP/JPY It’s Thursday, and weekend is coming, i definitely don’t want to hold any CHF or JPY over the weekend. SNB has already confirmed their intervention, and last time they intervened without any notice….a lot of people went bankrupt. Another reason is that the selling of GBP is going to push EUR/GBP higher as this is the end of month as well for EUR/GBP month-end rally. I got out of GBP/JPY with the same reason as well, don’t want to have any jPY position over the weekend, and also don’t want to have 2 short gbp position over weekend. Then, I got out of GBP/USD half and set the other to BE. I”m going to trail it down every 100 pips and if nothing happen before Friday, I’m just going to exit everything. But then after an hour of the speech, I decided to get out the other half. Again, it’s Thursday and I have no intention to hold anything over weekend. and i don’t think there is any force that going to drive the pair down to 1.3000 from today to tomorrow ( of course i might be wrong) We also already dropped 250 pips for the day. Most likely it might rebound and stop me out at BE. So just get out, be flat and have a good rest of the day - until tomorrow. The lesson I learned is really same as yesterday, everything worked out as planned, however, I could have limited my risk, increased my profit if I only i could have WAITED PATIENTLY with a better level. Sure, the risk is that I might lose the trade all together, but in a long-term perspective, I’ll have more profit in my pocket, less stresses and better management. Of course, it’s easier say than done, especially to face my own psychology. SHORT EUR/CHF from 1.0850 SL @ 1.1025 Profit $199 SHORT GBP/JPY from 137 SL @ 140 Profit $149 SHORT GBP/USD from 1.34 SL @ 1.3750 Profit $399

1 Comment

6/29/2016 0 Comments Fear of missing outFear of missing out has always been the biggest struggle in my life. It reflects in every aspect of what I do, and of course, it shows vivid in my personality. Wanna some examples? I am….(start with I) -Impatient -Impulsive -Inconsistent -Inadequate…. and these are just part of the product of “fear of missing out" I’m always impatient and chasing for the next “big thing”, because of fear that i’ll miss out the next “big thing" Same goes for impulsive, inconsistent and then always started the “big thing: but then saw another “big thing” and stopped what i was doing all of a sudden - inadequate My current positions EUR/CHF, GBP/USD & GBP/JPY all turned against me... Of course, they’re still far away from my stop loss and I have no problem to hold them because fundamental and sentimental reasons are in my favour. However, I entered these trade without fresh fundamental & sentimental reasons…. I entered them because i feared that I’d miss the big action since I already missed it in the actual Brexit. However, I made a very fatal mistake by entering a trade with price action only. Now, there is nothing wrong to enter a trade with price action, however, understand that if you have entered a trade with price action only, then you will also exit a trade with price action. Most people buy high and sell low which always end up losing because they enter the trade with Price Action only - completely disregard the fundamental & sentimental side. The buy high because the price action just made a new high, they sell low because price action just made a new low! And the end, they always buy at top and sell at bottom, and believe me, i was one of them! Although during the years, I have completed changed my trading style and nowadays will only enter when there is fundamental or sentimental reason, however, I’m still suck at “waiting patiently”. Yes the fundamental and sentimental were still favour the bearish outlook for EUR & GBP Yes eventually EUR & GBP will keep going lower However, my timing was wrong… The sentiment of Brexit was LAST WEEK so….why did I enter trades without any new, fresh fundamental & sentimental reasons? Was there any new fundamental updated? No Was there any new sentimental updated? No The only reason is that price action has retraced….and i got impatient... Again, it’s fine to enter the trades EUR/CHF GBP/JPY GBP/USD because i’m in the correct direction of these trades, but my timing was wrong And if i only entered because of the price action retracement, then I should have taken my profit when i had 100 pips in GBP/JPY GBP/USD and got out of EUR/CHF is i’m in the range bound. Anyway, new lesson everyday and hopefully I’ll work more on my psychological aspect of trading. Yes, at the end of the day, it is always the psychology that makes the winning trader! (and losing trader) Curent Position SHORT EUR/CHF from 1.0850 SL @ 1.1025 SHORT GBP/JPY from 137 SL @ 140 SHORT GBP/USD from 1.34 SL @ 1.3750 6/28/2016 0 Comments Another quiet day

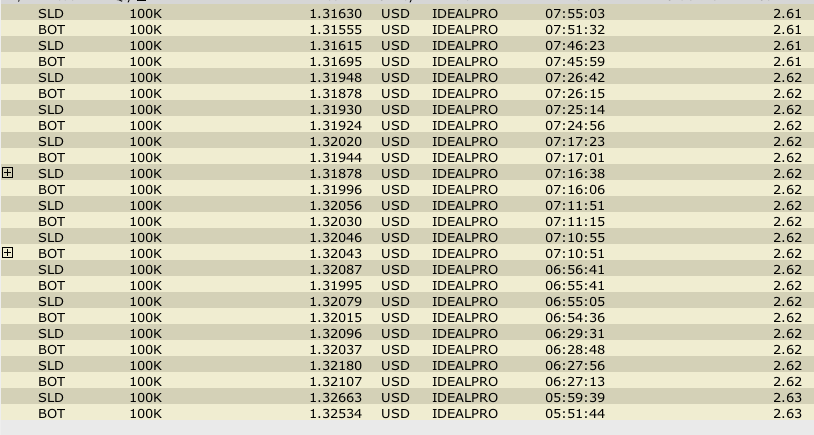

Today was another quiet session, the market did a bit better from the Brexit, but now the whole thing is surrounded by the politicians of Britain and Euro, a bunch of political drama now. It felt that the whole world is trying to move on, or better, completely disregard Britain. No surprise, although i personally love London, Britain has not been a world super power for a very very long time. I guess the main coverage was due to their financial industry, which are tied to everything i do and all the TV and news articles i paid closed attention to, but once outside trading, i realized no one is even talking about it anymore among my non-trader circles. Anyway, quiet session and still waiting for the price actions to retract to adequate level. The whole fundamental picture is still bearish toward GBP and EUR, and bullish toward USD, CHF & JPY. The trading idea is very simple nowadays, before this chaotic in Brexit settles down, which will probably take few weeks or even longer, every economic datas will be highly disregarded as people will only follow the sentiment of risk on/off So, whenever you find a good technical level, just sell GBP & EUR and BUY USD JPY CHF This will probably be the best trades for weeks. Of course, the risk is the price actions, short-seller covering and central bank intervention, which WILL happen for sure. The best way to protect yourself is to have wide stoploss, only enter at good level, and be patient, let the market present the opportunity to you. We have many pending orders but now we’re in SHORT EUR/CHF from 1.0850 SL @ 1.1025 SHORT GBP/JPY from 137 SL @ 140 that’s it. I must say that when times like this, the patience is your best trading method….which is always what i’m really bad at. 6/27/2016 0 Comments Post Brexit +$623Today is the 1st Monday after the Brexit - which led to leave. Last Friday was a wild market and unfortunately, i twas too wild for me to trade. I have been burned many times so my instinct was to stay flat, and therefore i did not really trade with the election result. Although i still managed to make $800 profit out of 300 pips and very small lot, but comparing to traders i know who some of them actually double their accounts in one day, i'm really just a beginner! Anyway, we opened the market Sunday EST with gap down, and once again, i do not see any opportunity to trade because the gap itself is 200 pips, we're almost at 1985 historical low of 1.32. There is no fundamental or sentimental reason for me to enter at this bottom. I stayed up to watch news, and read article, Goldman Sachs analysis predicted the cable to go as low as 1.32 and ended the year at 1.34 while a lot of banks predicted it to go as low as 1.20-1.25 Nevertheless, with 200 pips gap down and no more force to push cable lower, i have decided to scalp some money at 1.32 handle. The method is easier, i would wait for the pair to make fresh new low at 1.32 and buy with 10 pips sl and profit, then whenever it dropped another 10 pips, i’ll buy and aim for another 10 pips. So that was what i did, for 14 times in total. I also enter at 1.3250 before to grab 10 pips. At the end, i made some money. However, I should have just entered at 1.32 and then wait for 20-30 pips profit, and then at 1.3190 and wait for another 20-30 pips and finally at 1.3150 and wait for another 30 pips. I’d made the exact same amount or even more with less trades. However, that will require me to have more patience to wait….and PATIENCE is what i always lack of in my life!!! So the lesson is really to have enough patience in the market, wait for the market to give you opportunities to trade instead of force trading. Hope I’ll learn and do better next time. |

Archives

August 2016

Categories |

RSS Feed

RSS Feed