|

7/28/2016 0 Comments Less is more -$298

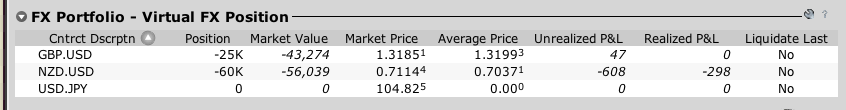

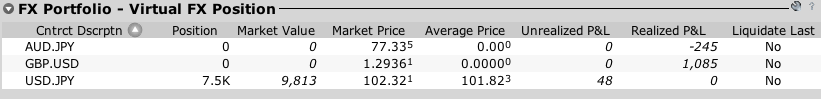

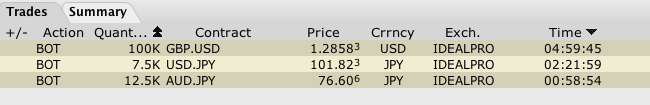

It has been a quite relax week for me, and it’s definitely because of the summer heat, or i’m just getting excited for my wedding in September and entertain my friends and relatives in Aug. I somehow really felt that way in the financial market as well, of course, market never stops and money never sleeps; but like I mentioned before, after the Brexit months ago, people are kind of relax after those tensions and expectations. I think we’ll continue to be like this until after Sep when things are picking up again and the world will once be in tension especially for the US election. My current trade had all be rangebound and nothing new is happening, I got out of my USD/JPY trade at BE and now waiting to see what’s going to happen tomorrow after BOJ release. My NZD/USD also got stopped out at BE with one position in. I also got in a new GBP/USD trade today. You can get newest update at here. At the end, not really an excited week, and we’ll see what August brings us. My NZD/USD shows a loss below because my brokerage unlike MT4 does not treat orders separately. Basically it combines the same currency together and calculated from that combined point. Yes it is confusing sometimes, but gladly i got my own trade plan and journal so I know exactly what my exposures are. OK again hope we’ll start Aug with great result.

0 Comments

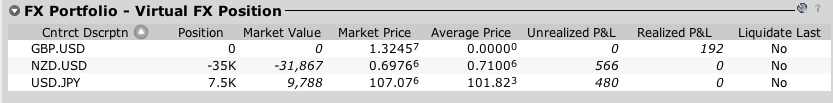

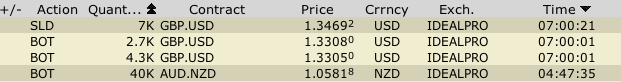

Today I saw the madness of the market again. The session started with quietness, no significant movement then near the NY session, there was news saying BOJ stating there will not be any helicopter money... which was already stated last week, and nothing new at all, however, the USD/JPY and all JPY pairs dropped 100 pips or so, USD/JPY went to almost 200 pips drops. I laughed, could this be possible? is market really this crazy? Of course, i got in and bought at the low of the session, and now holding the trade again. 10 minutes later, the news came in saying that the comment from BOJ was from the interview back in June... So basically, market reacted to something not only has already stated in the past, but without even confirmed whether it’s a new piece of information or not, in a most violent way. Then i realized this is exactly why successful traders can make so much money, because of the 95% of people are really, truly irrational. As mentioned, my mentor Nick doubled his account during the Brexit result in one day. But why can he do it? Because the market was reacting irrationally which gave him big opportunity to make money. People were buying GBP like crazy, and the higher it went, the more afraid the crowds were not to miss the action. I guess at the end of day, it’s always good to remind myself that i’m in the business of trading and trading is a zero-sum game! The more people lose, the more chance I’ll have to make money. And no matter how much teachings and informations are available, at the end, losers will always let the emotions take over their logic - which is how I know that I’ll never be out of job, because the human emotions are repetitive, predictable and irrational. I got out of my GBP/USD trade today with small win; still in NZD/USD & USD/JPY but not yet updated to the newest position, check out my orders/updates. I'll post a new snapshot tomorrow. 7/19/2016 0 Comments Trading is very boringand it is fantastic if you start feeling this way.

Today was another quiet session with no significant news, all tier 1 datas are disregarded because market is highly sensitive to the current sentiment globally, and i felt that the nice weather and summer time have slowed all the excitement down…. I think ever since the Brexit, everything just went sort of quiet, or maybe i’m just tired and wanted to get away from the screens. Or, maybe i’ve become better so trading has become boring. I remember my mentor once said that when you become good at trading, it will actually become very boring, no excitement for your profit/loss and no unnecessary risk taken. Basically everything will be under your control including your own emotions. So yes your performance will be great but you will never feel that excitement again when you first started. Of course, you’ll still love trading, but don’t lose the aim by “making them exciting”, in fact, accept that this boredom is a sign of your maturity as a trader and seek excitement somewhere else in life. I think it’s so accurate!!! Anyway, check out my orders/updates for newest trades i’m in. Other than that, enjoy the summer while you can - i know our summer here in Canada is always very short! 7/19/2016 0 Comments Tired Monday after the weekend

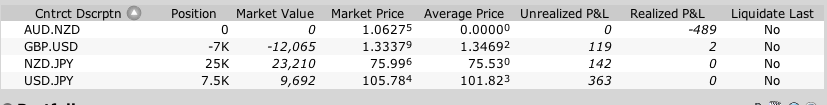

Had a really rough sessions last night due to sleep pattern. As many of you know, I’m trading the London session in Eastern standard timezone, so i’m working at 2am - 11am EST Monday to Friday. Although there many benefits to work around these hours, such as quietness and no distraction, but these are still the hours of night shifts for most people so often at weekends, I do wanna socialized and sometimes I’d carelessly mess up my timezone. So Monday was a very tired day for me yesterday, thankfully Monday was always a quiet session so I pretty much fell asleep…and it was a great sleep! Nothing much happening in the market, of course it’s always a good things because that means there were no terrorist attacks, tsunami or global events, but as you know, we traders make money out of these uncertainty. My current trades are in the orders/updates. Other than that, just keep enjoy my quiet night. Today i started the session with my old habit of mistakes and was very disappointed about myself; however, nowadays what changes is not my internal personality, rather, it is how i learned to catch my old-self and amend him immediately. That’s really the power of habit, is not you have changed yourself into a different person, rather, you have created a strong habit to amend and help you to make the better decisions while all your internal self is still inside. I’ve lost 40 lobs by changing my habits in the past 3 years, however, nothing has changed internally for me, every time i see delicious and unhealthy food, my urge to eat, to binge, is still there and will always be there. I simply create a new habit for me to follow, and a new “desire” with future projection, such as Tony Robbins’ “pain” and “pleasure” mechanism. I simply replace the “pleasure’ of eating delicious but unhealthy food to “pain” of eating unhealthy food and feeling unhealthy in life; then switch the “pleasure” of eating delicious good to “pleasure” of not eating unhealthy food and have amazing health with energy to enjoy life’s other pleasant things. Again, if it sounds complicated, i recommend reading Tony Robbins book. So exactly what happened today? well i got in on my trading routine, everything went fine until I saw AUD/JPY chart that was in the same direction as my fundamental analysis. “oh man it’s really going up now" then, instead of sitting down to write my plan, i jumped in the trade because the fear of missing. It went up, and went down, and went up, and down, and my heart was pumping, i started at the monitor…then suddenly i realized what the heck am i doing? I had no plans at all!!! I realized what a huge mistake i’m making and immediately gotten out at BE. Thankfully! Then, i slowly wrote my plan, which is actually exactly the same, still LONG AUD/JPY but the difference is the mentality. Now I have a plan, an entry, an exit, scenarios to manage the trade, what to do when what happens…etc So if looking from outside at my action, there is no difference. Enho is long on AUD/JPY and got out. Enho is long on AUD/JPY again at exact same spot... However, the internal is what really makes a difference between winning trader and losing trader. Because let me tell you, when things are going well, we never thought how important it is to learn our trading psychology. But only when you’re losing, you’ll realized how important the trading psychology and having a trading plan is. The 2 scenarios might be the same, Enho entered Long on AUD/JPY and if AUD/JPY goes up all day, Enho is feeling great! However, what happened when AUD/JPY goes down? The first Enho would immediately feel panic, he had no plans, no ideas, no scenarios on what to do, he’ll most likely check the news, start second guessing himself, then he’ll go on forum and start asking others’ opinions. He is vulnerable and clueless. Then, he’ll make a decision because someone on the forum would say “AUSSIE? Man RBA is going to cut rate FOR SURE" This person on the forum might be right, and he is simply stating his long-term view for AUD. However, that was never the reason ENHO entered, but at this vulnerable point, Enho would just exit the trade with a loss, and a bitter feeling. Then, suddenly, AUD/JPY goes up again and now is soaring, Enho immediately felt huge regret, he again checked the news, checked his dog, checked everything but his plan because he had none. He wants to jump in again and he did. Then he secretly blamed the guy on the forum, “what a stupid idiot!” I hope the above scenario does not sound familiar to you, but that Enho was exactly who i was back then. And that’s why i’m very happy today, no action, no loss but most importantly, i’m happy that my new habit, my new learning, my progress has allowed me to transform myself into a winning trader. Currently i’m still holding USD/JPY and GBP/USD, if you want to get instant updates, follow my twitter and check out my orders/updates page, there will be the newest updates for my trade. Other than that, have a great weekend and hope you have learned something from my mistakes. Thank you 7/14/2016 0 Comments Risk is like a virus -$490if you’re exposed without protection (stop loss & proper leverage), you die

If you’re exposed with proper protection (stop loss & leverage) and always retreat when you have to, you’ll survive. If you’re exposed for no reason, you die Trading essentially is merely a game of probability. All your economic theories, news analysis, technical charting…etc are merely tools for you to play this game of probabilities. And because it’s just a game of odds, you’re going to lose from time to time, and it’s ok to be wrong - but it’s not ok to gamble. And for me, trading without a plan = gambling. So, if you have a plan, a step by step, a clear thought, then when things start working against you - you should follow your plan and get out. That’s exactly what I did with my AUD/NZD trade. My loss today was great, because i followed exactly as what I have planned. (Of course, I would never felt this way back in my old days, my mood and emotions were always effected by the amount of money i made/lost.) I entered the trade because of certain condition, and my plan was that if that condition disappear and the market price action has confirmed, then I will get out! (However, I will say that maybe I should have gotten out even earlier prior to AUD data release because I had very little conviction for the datas and if i was already at BE, then should have just gotten out to avoid possible risk - and of course you have to be ok with possible reward as well) Sounds simple? Yes, but this simple fact of human behaviour is the hardest part and critical part to differentiate a winning trader and a losing one. Or, i should say it’s the essence to differentiate a winner in life and a loser in life. The logic of human being is never hard to comprehend, but the emotional barriers of our lives are the most difficult part of us. Who doesn’t know smoking is bad? Who doesn’t know excessive drinking is bad? Who doesn’t know overeating is bad? Who doesn’t know you should save money? Who doesn’t know you should’t lose your temper and have a road rage? ……etc Yet, we make all the mistakes not because we are incapable of comprehending the logic, rather, we’re powerless to deal with our subconscious mind that is largely assembled by our emotions, past experiences and our current habits. So my advice to any traders is that your trading psychology will be your critical point of becoming a winner, or forever remain a loser. It took me years of practicing and learning, yes it can be done, and yes it takes hard works. If you want to learn more, I recommend reading “Power Of Habit”. It’s a fantastic book for anyone who wants to change their life. OK, my current orders are in orders/updates Today i loss $490 from my AUD/NZD trade, currently still have 3 trades in. Watch out for the CPI data tomorrow from USA! 7/13/2016 0 Comments Summer heat in BritainToday was another quiet session with no real data to trade, of course Canada rate decision was tier one data but as expected the rate was unchanged.

However, it did fluctuated 100 pips so good chance to scalp if you know what you’re doing. I stayed out most of the session since my overall exposure has already met, that means no more trades for me unless i exit some. Currently all my trades are in profit or BE but since i’m holding them as swing trades, not really looking to get out anytime soon. Tomorrow the BOE decision will be very interested and really looking forward to that. David Cameron finished his last day as the Prime Minister! Every time I watched news about Britain or when their officials make comments, the only thing that comes to my mind is “damn….I wanted to have a British accent!" yeah….that’s pretty much it, but really the accent sounds so nice, elegant and just like an old English movie. Of course, no matter how good your English is (or how bad it is in my case), you can never really change your accent once you pass certain age. You could if you try, especially if English is your native language already. But it is extremely hard for us non-English speakers to speak English well, not to mention what kind of accents…. So that’s my only wish if i have kids in the future, is to let him/her grew up in Britain for couple years, get that accent and leave! haha Other than that, generally it has been a very quiet week so far, getting kind of lazy because of the summer heat ~~ ok safe trading everyone! P.S i’m still trying to upload my daily analysis as soon as i can but the video always takes so long to rendering, so if you want instant updates then please check out my orders/updates. Again, please do not follow the trades blindly, they are for educational purpose only thank you Yesterday I went to watch The Legend of Tarzan.

I felt very touched by the movie, not because of the plots, but because of the animals. As most of you know the story of how Tarzan grew up in the forest and raised up by the Gorillas, and it brought back so much of my childhood memories. I grew up in the county side prior to the internet, I remembered back then when i was a child, my best friends were always the dogs, cats, frogs, butterflies or all the weird insects in our neighbourhood. The kindergarten I went was an experiment institution in our community, and they had bears, monkeys and all the creatures inside where kids can play around with them. Not the bears of course. And yes it is illegal. Of course, when later on the laws became more strict in terms of animal protection, the school was shut down and yet, i spent nearly 2 years in that place. Besides that, there was a small forest hill just beside my house, so naturally that was where we always played. I rode my bike, played with the dogs, got beaten by the insects, fell down and cried and always came home with dirt and mud. But that was such an amazing times in my childhood. Then time goes by, we got so much technological inventions, things that were beyond people’s imaginations. And now we live with our inventions everyday, and we use them to conduct our daily cavities and businesses. Don’t get me wrong, it is all very good and convenient However, after watching the movie, I asked myself “when was the last time I went outside and played around to get myself with dirt and mud, just like my childhood?" It’s a bit depressed to think that, but somehow all these technology makes us more apart from each other, from our animals, and from mother-earth. I really can't imagine when i have kids in the future, what is his/her childhood going to be? How different that will be comparing to my childhood? Anyway, I think from now on, I’ll really shut all my technology down and go out to the nature more often. OK, back to trading! As you might have noticed, I have added 2 features on my website now, one is the Daily Analysis and the other one is Orders/Updates. So pretty much all the trade info will be in these 2 sections. Today is another quiet session, no tier one data, the current sentiment continues as JPY being heavily shorted. We’re still favour buying commodity currencies against JPY, and we’re still bearish for GBP/USD. Our AUD/NZD got filled but nothing much happen because they both are the same commodity pair and will not react much in current situation, however, that was also the reason we chose this pair to hedge our risk. Our USD/JPY order is in profit of 200 pips +, however, the size was very small as originally we’re thinking to scale in only. What i learned is that if the central bank has announced certain policy changes, even though it’s not happening yet, it’s your best interest to just go with the flow. However, it also depends on which central bank we’re talking about. But when it comes to Japan, I often feel that they’re more like a kingdom of the old days. What i meant is that even though Japan is a democratic country, but unlike other nations, they really follow the order from above. So although each government department should be independently operates such as Bank Of Japan and each parties should supervised each other, but as for now, everything is really controlled by the prime minister Abe. He's got the power!!! ok, tomorrow BOC will have newest rate decision and as a Canadian myself….well, we don’t really care as Canada seldom makes any interesting news haha. See you tomorrow. 7/11/2016 0 Comments Eliminate your errors!!! +$840

Monday is always a quiet session, and I’m going to wrap up early to enjoy my day My cable trade from last Friday finally worked out as market sentiment shifts to further downside for JPY and increased risk appetite. I was very proud that although I wanted to close the trade so badly last Friday because i just hated carrying trades over the weekends, however, because my analysis was correct and I had enough conviction, i decided to hold my trade. The patience paid off, the cable dropped and moreover, I was able to hold it until it reached the 50’ area, and it turned out to be the lowest of the day for now. What a fantastic trade for me!!! This is really where my joy of trading come from, from analysis, critical thinking, knowing where my risk and put on the bet, and manage the trades with risk and also my own psychology…etc Unfortunately, my other trade AUD/JPY got stopped out, I was happy to only risk 0.25% last week as my analysis, and also moved my SL closer, however, I completely forgot i had this trade because of the low risk % and because i was focusing so much on my cable trade. I could have gotten out prior London opening because i already known the JPY is going to depreciated against all other currencies. So…I made another human error again….sigh... As mentioned so many times in my previous posts, the more trading errors you can minimize, the more possibility you’re going to come out as a winner. To win in the market is hard enough and you can never eliminate the risk in the market, however, you can always eliminate the risk in you. I used to have an order board and for some reason, I didn’t do it last week because I broke my habit of never holding trades over weekend, and when you break your own habits, a lot of things will get messed up... So anyway, i’m still happy for my win but frustrated for my careless error. Hopefully I’ll be better next time! Right now we only have 1 USD/JPY 0.3% risk in and we decided to play it in a long run as BOJ might introduced another stimulate package as soon as tomorrow, which i will be out to enjoy my day-off Monday. So let’s see what’s gonna happen. 7/10/2016 1 Comment Have a life!Today was extremely quiet….because it’s Saturday lol

Believe it or not, when i first started, I sometimes forgot it’s weekend and still opened my charts only to realized “hmm…how come the price is not moving?" I think when you first start trading, some of you will immediately fall in love with it, and some of you will not. However, those who immediately fall in love with trading, are not necessary the ones that are gong to be profitable at the end. I know, because i was one of them. What happened to people like us who “fall in love with trading” is that we tend to feel alive when there is something to trade, and we feel so bored and dead when there is nothing to trade. Generally, that leads to overtrading. Now if you’re trading stocks, then luckily the market will close and no more trades for you. However, if you’re trading forex, then the market never closed….like literally. So I often find myself trading one session after another session after another session until it’s Friday afternoon, and I’d still wake up at Saturday 12am to find out the price is not moving…because it’s SATURDAY! Thankfully those years are gone, because i had no life outside trading. I had no time for social, for food, for my dog, or even for sleep. And guess what? Regardless of how “hard” i work, i still didn’t make money. The truth is, if you want to trade well, you have to live well. That means trading is merely a reflection of your psychology. As i kept stressed in all my articles, winning traders do not have any holy grails, they just have better psychology. So it is essential to have a life outside trading. It will help you tremendously in trading, it will ease your stress, it will sharp your focus, and most importantly, why are you trading if you have no life outside trading? Think about it! What does trading mean to you? If you trade 24/7, and make tons of money (which was not my case and I highly doubt people who trade 24/7 make money), and then? And then what? You have no life anyway. Most people i know who has traded 24/7 lost everything. And if you’re the special one that trade 24/7 and still make money, well, you’re not making money, you’re simply trading your life for the money. And that in my point of view and past experience, already means I’m losing - in life. So have fun outside trading, shut off your computer, stop checking the markets and quotes, just go out and enjoy life! |

Archives

August 2016

Categories |

RSS Feed

RSS Feed