|

Today I had another loss from unplanned and un-routined trade. I can now immediately capture myself doing something outside my norm and found out the reasons. As mentioned, I’m about to have relatives coming for wedding and touring beginning this Saturday, and this has really disrupted my trading routine and habits - hence, the successive unplanned trade from Yesterday’s EUR/GBP to today’s GBP/USD. I know it often confuses people to judge a trade’s quality by the result of profit/loss, but that is not the case and that cannot be the case if you want to stay in this game long enough. The key to win is really to keep learning, develop your own strategy and trading routine, constant journalling every trades and reflect yourself…etc. You constantly change in life, and so does your trading style - so I always recommend people to stay away from trading if something very abnormal is happening in their life now; such as sickness, love ones passing, or for myself, wedding. I guessed i have under estimated the emotional effect of wedding event on me and now i have learned - with expensive tuition of $1000 of course haha. Anyhow, I took GBP/USD today out of FOMC minute, there is nothing wrong to trade this event - only that i normally never trade minutes alone. Not only that, if I want to trade any day trade, then i ought to be in the sessions to sessions so i can get a sense of the sentiment by monitoring and being there - which i clearly did not do as i had just woken up from my nap prior to this event. So yap, once again, to know yourself and to stop yourself from doing something that is not within your habit or routine is so important, because at the end of the day, market does not make you lose money, nor do other trades. You’re your biggest enemy and it is completely true in the market. So from now i’m not going to trade sessions day trade anymore until the whole wedding event is done and dusted. And if there is important economic releases, then I have to plan ahead such as my previous AUD/USD trade, although ended up in loser as well, but that was a great trade for me because i did everything right in my process and I was really proud of it. Remember, at the end of the day, your winnings are actually from eliminating your error and unnecessary losses, because every trade you really only have 50/50 chance, eliminate the ones that has less than 50% chance due to your own psychologic error = you will come out as a winner at the end. OK, happy summer guys! Remember to journal your trades and/or thoughts, you’ll learn so much from doing it.

0 Comments

I used to love scalping! It’s fast, quick, and so suitable for my impatient personality. But perhaps the best part is this feeling of making instant reward! Who doesn’t love it? Making money within 1 or 2 minutes, it’s really addictive feeling especially when most people are making an hourly salary job. However, the cost of scalping is really not to overtrade. Back then i used to take 20 plus trades everyday, 100 trades a week, and although the profit and loss was negative, i still continued doing it…why? Because that’s exactly the same reason why gamblers gamble away their fortune. Even though in the long run they lose, but the short-term reward, the feeling, the addiction can trigger your brain to release chemicals, so although you’re losing on paper, on data, on every realistic way, emotionally you felt like a winner - hence, you are addicted. Nowadays i still do scalps, but i only limited myself to do it when there is important and tradable news release. It has totally helped me to transform my trading. As mentioned, at the end of the day, to trade well is to know yourself completely. Today i entered a trade I shouldn’t have entered again…and yes, i was back in my old habit of scalping for the sake of excitement. The only thing i did it right was to lose very small, 0.2% and i set up my SL right away because I know if i don’t, once the price comes down, i might not be able to get out due to my mental block. Anyway, the trade ended up as a loser, but it was a loser already from the very beginning because when you trade something outside your routine, when you trade randomly without a plan, then no matter what the result is, you’re a loser. I’m glad to lose just small amount, but really disappointment about myself. well, you trade and learn. 8/16/2016 0 Comments Summer is almost done! -$831

Finally we’re stepping into the mid Aug and I’m going to be away for the next 2 weeks. Honestly after trading for so many years, I always love to keep in touch with the market even when i’m on holidays, no i do not feel i’m working, i just love the excitement of trading too much!!! Sorry about the late updates and all, but i’ll keep my swing trade going for the next 2 weeks and hopefully you can still learn something from me. Here are the updates so far from days ago: 8/10/2016 1 Comment Enjoy the weather! +$473

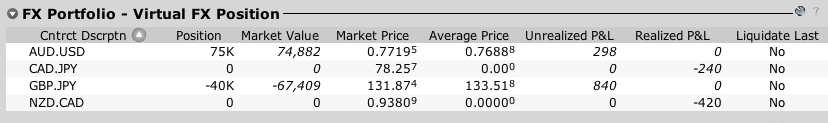

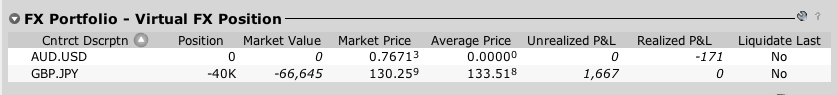

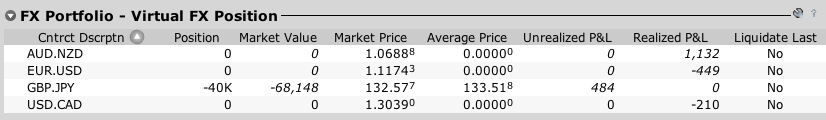

We had another excited week so far but i guess because i missed the boring Monday and Tuesday, took a short trip to the winery and enjoyed the beautiful summer. It is so important to shut off your computer from time to time and really step outside to the mother nature. And i think this is another reason I’m a big fan of swing trade. When i first started trading, I spent 12 hours or more a day in front of the screen, hoping to make 10 - 30 pips and felt so happy and proud if i could do that. But then I grew up, experienced life and realized that the most important asset of this life is not the money amount, but the TIME. If i make 10 - 30 pip a day, or just say i make $1000 a day by working 15 hours. That will be $65 dollar or so per hour. VS if i do swing trade or even my London Box which i only work 6 months of a year, 10 minutes a day. (but of course, it’s an upfront work because i spent many hours and efforts to develop this system and now just enjoyed the benefit of it) I might make less in money amount, but i also spent less hours and if you divided the hourly rate, I actually make more per hour. Anyway, it’s just an interesting way to look at things at different age and different perspective. So i took a short trip to winery, enjoyed it vey much, and made a bit profit with my swing trade this week so far. Yes, i guess that’s the beautify of trading, let the money make money for you. Have fun learning and eventually hope everyone can have a stream of income that you don’t have to be there everyday. We finally wrapped this week and I had a roller coaster ride. However, the difference for my trading nowadays comparing to back then, is that I was completely calm in front of my losses. I still get excited over wins, but the most important thing for me is whether I trade in accordingly with my plan. If i have plan, scenarios, and execute them well, then for me, the result will only add on about 10% of emotional feeling. 90% of my satisfaction will mainly from my whole process of trading. Of course, if I have a stream of losses, then perhaps the process needs to be tweaked but the individual trade result should never alter your trading habit or style. Another thing you might notice from my entry is that I initially have a risk management of 2% for myself, and that’s by all means my personal trading habit to purposely help my previous bad habit. I was over-trading and had many bad habits of taking too much risk, I also had experiences of blowing up accounts. So think about it like a sober alcoholic. (although I’m not one) I assume at the beginning you get addicted to drinking and are constantly in pain (like how i got addicted to over-trading) People around you are worry and perhaps want you to seek help that you are most of the time in denial (like how i used be with my over-trading and blowing accounts “it’s not me it’s the brokerage’s fault…etc) Then finally you’ve waken up and decided to seek help from AA (like how i finally seek mentorships and learned from the beginning) Then you started setting up rules and environment that you cannot touch any drinks or associate with people who used to be your drinking buddies (like how I closed my trading account and perhaps traded demo and learned for a year and then traded with 1/10 of the money i have) Then eventually you’ve completely rewired your brain and changed, now you can be in front of alcohol knowing that you have the power to say no (like how I completed changed and rewired my brain and can manage a large account but yet still control my risk exposure and never ever blowing up things again) So yeah, i guess it’s pretty much like that, or my food addiction and overcome it to lose 40lb from 2014 until now. So now I don’t use 2% overall risk, instead, I still use 1% per trade but I never want to hold the same currency twice. So it means if i’m long EUR/USD and short USD/JPY, i’m essentially selling USD twice which is NOT allowed. This is a great way to deal with your risk exposure and it is very dynamic in your trading. You can essentially take any trade you want, but just never hold too much in one single currency. If I trade this way with only 8 major currencies to combine, essentially I’d only have 3 pairs at any given time. However, sometimes in my swing trades where I’ll add on if I’m in a good trend, then that will give me few more rooms to go - so I give myself around 5% total risk exposure on the table. But to reach 5% and not buying/selling same currency twice is almost impossible. So far I always only have 3 max pairs with maybe 1 or 2 add ons. In this way of trading, the risk to have all pairs go against you is very minimal as some of them all correlated to each other. It’s a new way of managing my risk and been working well so far. Of course, I did not invent it as I did not invent anything in trading, and yet every time from books and mentorships, i get to learn so much cool new insight. So once again, keep learning my friend. ok have a great weekend and we’ll be back for another exciting week.

We started Aug with some excited movement for myself: First of all, I have decided to add 2 more free trade alerts for my free members. One is a daily strategy for people who only want to trade once a day with a very passive and relax style. I used to use this strategy with a very good result, but i was a pure technical trader and sometimes just suffered many losses because i was completely unawares of the market sentiment, news and the fundamental side of the economy. I started implanting the fundamental & sentiment analysis into my daily trade with the same technical strategy and it has been providing a very good result so far. On top of that, i also tweaked some money management style to take the best opportunity in this strategy. So now i’m very excited to trade them myself and also share with my members. Of course, all my alerts are really only educational purposes and at the end of the day, you have to really develop your own strategy and risk management style to fit who you are. My #1 criteria in deciding to take a trade or not is still risk management and will always be risk management. Second strategy i added in for free members is London Box. As mentioned in my FREE STRATEGIES page, i developed it with the help of my mentor Walter Peters, and I added few tweaks with 10 years of backtesting because it is a mechanical system with some fundamental personality in these particular 2 currencies. I only trade this currency pair for this strategy and it has been working very well, however, I personally don’t trade them anymore because the drawdown is too large for my styled - up to 25%. The average return for the past 10 years is 16% and you will have years of no return at Break even and years of 50% plus return. I also changed a bit of my trading style in my intraday trade, and i’m just very excited overall to learn more about myself again. So Monday I took a EUR/GBP LONG trade due to sentiment play and it has worked out. Unfortunately, today my EUR/AUD trade did not work out and it’s many because of my own risk management style. The thing about trading the news or trading for any catalyst is that you have to know this will be the most violative event for the currencies. Not only no one can predict the result, but no one can predict the market reaction. Market can always buy the rumour and sell the fact, market can also buy the rumour and keep buying after the fact, or market can not buy the rumour but but the fact, or market can simply do nothing…etc Because of that, it is always a good practice to either scalp whatever you can for this kind of event, of course, you limit yourself to small profit and get out when the fundamental is still in your side. Personally i don’t scalp that often because I just don’t like to get out of a trade when i’m winning without any proper reason. Second style is to use a larger stop loss. Why? Because you will never know how violate the event is, and remember you always have sellers and buyers who are equally interested to sell and buy for this event. You always have different style of traders with different goals. So your normal daily range will not be sufficient to protect yourself - which was exactly what had happened to my EUR/AUD trade. Sure, AUD actually has been bought after the rate cut - which a lot of traders might panic and find it’s illogic. However, it’s very logic because a lot of traders are always in favour of buying AUD. Regardless of the new 1.5% rate, AUD is still very high yield in comparison with other currencies, the fundamental side of the country is still very attractive, and the carry trade position with Japanese yen will also always be there for now. So If you look at their prospective, you’d understand that whenever AUD drops, it just becomes more attractive for them to buy. And precisely because of that, you should always protect yourself with a larger stop loss in this kind of event. Anyway, I guessed I should have known, but the thing is that you’d always learn in the market; not the textbook. And every lesson you learned with money (loss) will always be a great lesson to remember. I have paid my $1200 tuition today, and I will keep this lesson in mind. The thing i’m really proud is still my risk exposure, as i have exited my GBP/USD trade prior to the event, and also tighten my SL for EUR/GBP trade because i don’t want to expose too much on the same currency - euro. And it turned out that EURO did changed the direction and we have offset some of our losses with 1 wins in EUR/GBP and a Break even in GBP/USD which at this moment has gone against us in more than 150 pips if we had not exited it. Good call Enho 😃 8/1/2016 0 Comments Welcome to the August -$1123Aug is finally here!

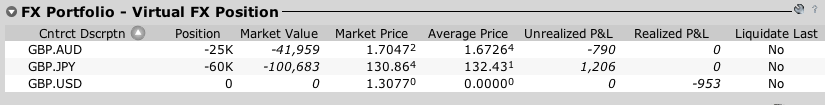

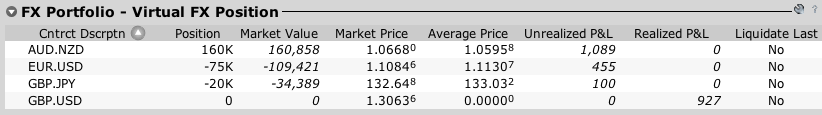

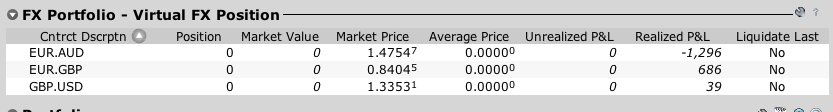

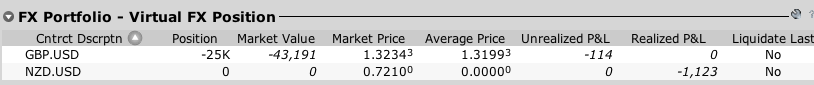

Honestly, i did not feel any sense of summer vacation, but then again, I haven’t been feeling that ever since I said goodbye to my student life!! Now to think about it, being a student was really a great treat, a fantastic time of freedom and fun! July was a very interesting month, I have learned a lot of new knowledge from my trading, mentorships and books, have also benefited a lot from this website, by writing the blogs, daily analysis and order board, I actually created an accountability partner for myself to be disciplined about my trades and trade journal. In terms of my performance, as you might have noticed, i actually lost a whole 1% last Friday which reduced my monthly return to 0% - it’s a break even month. If you asked me, of course emotionally i felt a bit frustrated not only because of the loss but also because it had to happen at the last day of the month 😔 However, i was really happy because there is one thing i did it correctly all the way, and that is always controlling my risk exposure! There are many many things that can go wrong, many unexpected surprises that can go against you, and never ever say impossible - because in this market, impossible always happens once every few years, and some people always lost greatly because of that! So if you agreed and understand the essence, then you’ll understand that the only thing you ever really have control in this market is your own risk exposure. So pay 100% attention to that, because that’s the key for you to become a successful trader. Below was my Friday performance: |

Archives

August 2016

Categories |

RSS Feed

RSS Feed