|

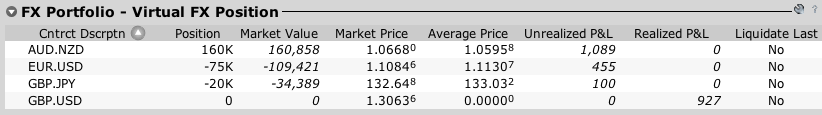

We finally wrapped this week and I had a roller coaster ride. However, the difference for my trading nowadays comparing to back then, is that I was completely calm in front of my losses. I still get excited over wins, but the most important thing for me is whether I trade in accordingly with my plan. If i have plan, scenarios, and execute them well, then for me, the result will only add on about 10% of emotional feeling. 90% of my satisfaction will mainly from my whole process of trading. Of course, if I have a stream of losses, then perhaps the process needs to be tweaked but the individual trade result should never alter your trading habit or style. Another thing you might notice from my entry is that I initially have a risk management of 2% for myself, and that’s by all means my personal trading habit to purposely help my previous bad habit. I was over-trading and had many bad habits of taking too much risk, I also had experiences of blowing up accounts. So think about it like a sober alcoholic. (although I’m not one) I assume at the beginning you get addicted to drinking and are constantly in pain (like how i got addicted to over-trading) People around you are worry and perhaps want you to seek help that you are most of the time in denial (like how i used be with my over-trading and blowing accounts “it’s not me it’s the brokerage’s fault…etc) Then finally you’ve waken up and decided to seek help from AA (like how i finally seek mentorships and learned from the beginning) Then you started setting up rules and environment that you cannot touch any drinks or associate with people who used to be your drinking buddies (like how I closed my trading account and perhaps traded demo and learned for a year and then traded with 1/10 of the money i have) Then eventually you’ve completely rewired your brain and changed, now you can be in front of alcohol knowing that you have the power to say no (like how I completed changed and rewired my brain and can manage a large account but yet still control my risk exposure and never ever blowing up things again) So yeah, i guess it’s pretty much like that, or my food addiction and overcome it to lose 40lb from 2014 until now. So now I don’t use 2% overall risk, instead, I still use 1% per trade but I never want to hold the same currency twice. So it means if i’m long EUR/USD and short USD/JPY, i’m essentially selling USD twice which is NOT allowed. This is a great way to deal with your risk exposure and it is very dynamic in your trading. You can essentially take any trade you want, but just never hold too much in one single currency. If I trade this way with only 8 major currencies to combine, essentially I’d only have 3 pairs at any given time. However, sometimes in my swing trades where I’ll add on if I’m in a good trend, then that will give me few more rooms to go - so I give myself around 5% total risk exposure on the table. But to reach 5% and not buying/selling same currency twice is almost impossible. So far I always only have 3 max pairs with maybe 1 or 2 add ons. In this way of trading, the risk to have all pairs go against you is very minimal as some of them all correlated to each other. It’s a new way of managing my risk and been working well so far. Of course, I did not invent it as I did not invent anything in trading, and yet every time from books and mentorships, i get to learn so much cool new insight. So once again, keep learning my friend. ok have a great weekend and we’ll be back for another exciting week.

0 Comments

Leave a Reply. |

Archives

August 2016

Categories |

RSS Feed

RSS Feed