|

7/14/2016 0 Comments Risk is like a virus -$490if you’re exposed without protection (stop loss & proper leverage), you die

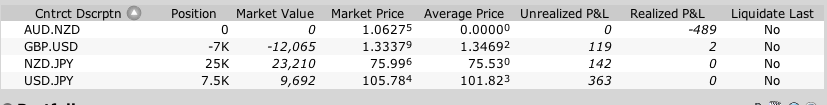

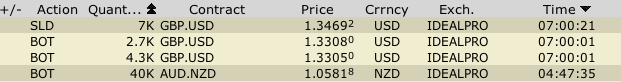

If you’re exposed with proper protection (stop loss & leverage) and always retreat when you have to, you’ll survive. If you’re exposed for no reason, you die Trading essentially is merely a game of probability. All your economic theories, news analysis, technical charting…etc are merely tools for you to play this game of probabilities. And because it’s just a game of odds, you’re going to lose from time to time, and it’s ok to be wrong - but it’s not ok to gamble. And for me, trading without a plan = gambling. So, if you have a plan, a step by step, a clear thought, then when things start working against you - you should follow your plan and get out. That’s exactly what I did with my AUD/NZD trade. My loss today was great, because i followed exactly as what I have planned. (Of course, I would never felt this way back in my old days, my mood and emotions were always effected by the amount of money i made/lost.) I entered the trade because of certain condition, and my plan was that if that condition disappear and the market price action has confirmed, then I will get out! (However, I will say that maybe I should have gotten out even earlier prior to AUD data release because I had very little conviction for the datas and if i was already at BE, then should have just gotten out to avoid possible risk - and of course you have to be ok with possible reward as well) Sounds simple? Yes, but this simple fact of human behaviour is the hardest part and critical part to differentiate a winning trader and a losing one. Or, i should say it’s the essence to differentiate a winner in life and a loser in life. The logic of human being is never hard to comprehend, but the emotional barriers of our lives are the most difficult part of us. Who doesn’t know smoking is bad? Who doesn’t know excessive drinking is bad? Who doesn’t know overeating is bad? Who doesn’t know you should save money? Who doesn’t know you should’t lose your temper and have a road rage? ……etc Yet, we make all the mistakes not because we are incapable of comprehending the logic, rather, we’re powerless to deal with our subconscious mind that is largely assembled by our emotions, past experiences and our current habits. So my advice to any traders is that your trading psychology will be your critical point of becoming a winner, or forever remain a loser. It took me years of practicing and learning, yes it can be done, and yes it takes hard works. If you want to learn more, I recommend reading “Power Of Habit”. It’s a fantastic book for anyone who wants to change their life. OK, my current orders are in orders/updates Today i loss $490 from my AUD/NZD trade, currently still have 3 trades in. Watch out for the CPI data tomorrow from USA!

0 Comments

Leave a Reply. |

Archives

August 2016

Categories |

RSS Feed

RSS Feed